Experience the Power of PAMM Investment

Delegate your investments to professional fund managers and benefit from their expertise as your capital grows in global markets — with full transparency and control.

Why Choose PAMM Investment with Strategic Broking & Investments

Hands-Free Portfolio Management

Let certified fund managers trade on your behalf while you focus on your financial goals. No trading knowledge required.

Performance Transparency

Access verified performance data, past returns, and manager risk ratings before you invest.

Tailored Risk and Profit Sharing

Choose how much capital to allocate, define your risk levels, and earn a share of profits aligned with your investment.

Start Investing in PAMM in Just a Few Simple Steps

Sign Up and Fund Your Account

Create your Strategic Broking & Investments account and add funds securely using credit/debit cards, UPI, or bank transfer.

Browse and Select a Fund Manager

Compare verified PAMM managers by their strategies, risk level, and past performance to find the right fit for your goals.

Allocate Funds and Monitor Results

Invest in your selected manager’s account. Sit back while they trade—track performance, withdraw returns, or reallocate anytime.

Getting Started with PAMM Investment

Our beginner-friendly video guides help you open your account, select experienced PAMM managers, and manage your investments easily from your dashboard.

LET'S GET STARTED

Questions about PAMM Accounts

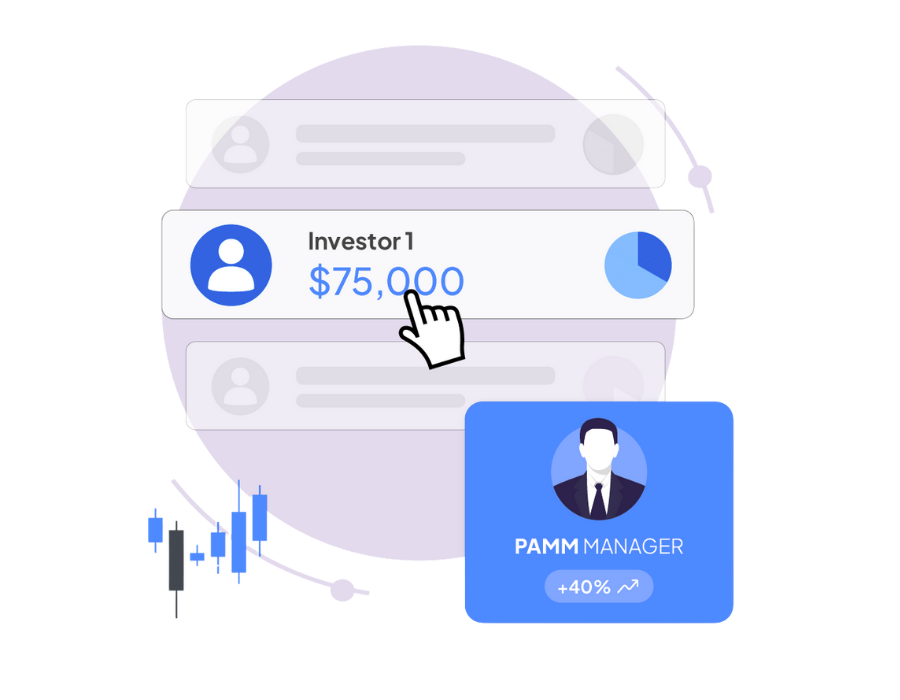

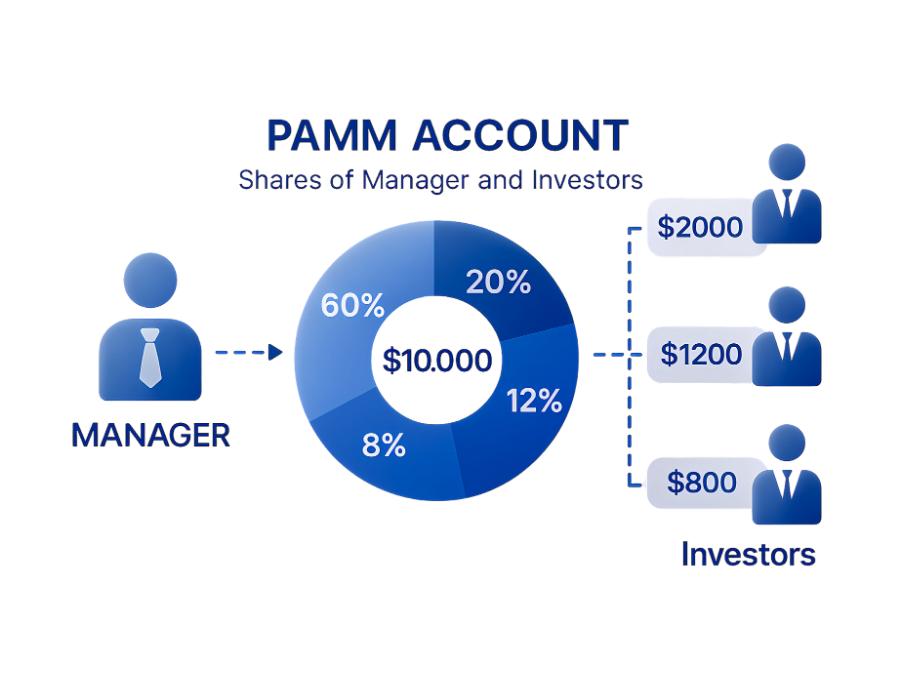

A PAMM (Percent Allocation Management Module) account allows investors to allocate funds to a skilled trader who manages multiple investor accounts under one master portfolio.

The trader executes trades on a central account, and profits or losses are proportionally distributed to each investor based on their share of the pooled funds.

Your capital remains in your trading account. While traders can execute trades, they cannot access or withdraw your funds, offering a layer of security.

PAMM accounts provide access to professional trading, portfolio diversification, and passive income opportunities—ideal for investors with limited market knowledge.

Yes, withdrawals are allowed subject to the broker’s withdrawal policy and timing. You can typically withdraw your funds or profits as needed.

Absolutely. PAMM accounts are ideal for beginners as they allow you to invest alongside experienced traders without active trading involvement.

Fund managers earn through a performance fee—usually a percentage of the profits they generate—motivating them to trade successfully on your behalf.

Yes, each PAMM strategy or manager may have its own minimum deposit requirement. This varies based on the trading approach and broker terms.

Yes, live performance data and detailed reports are available on your dashboard, allowing you to monitor returns, activity, and overall strategy performance.

As with all investments, there is a risk of loss. It’s important to assess each trader’s strategy, risk level, and past performance before investing.